About

Empowering Women and Communities Through Purpose Driven Microfinance

Uzima, derived from the Swahili word meaning “full of life”, is a forward-looking, socially-driven microfinance institution founded in Tororo, Uganda in 2023. It was established by three highly experienced development and finance professionals—Mr. Mamunur Rashid, Mrs. Sharmin Sultana, and Mr. Hem Chandro Roy—who collectively bring over 50 years of practical experience in microfinance, financial inclusion, and enterprise development across East Africa, Southeast Asia, and North America.

Uzima was launched during a time of global socio-economic uncertainty stemming from the COVID-19 pandemic and the ripple effects of the Russia–Ukraine conflict. These events have disproportionately impacted low-income communities, especially rural women entrepreneurs. In response, Uzima was founded with a clear purpose: to deliver transformational microfinance solutions that directly address poverty, promote women’s empowerment

WHY UZIMA

What Sets Uzima Apart

Sectoral Focus

Concentrating on key industries to drive targeted growth and meaningful impact.

Innovation & Sustainability

Integrating cutting-edge solutions with eco-friendly practices for long-term value.

Tailor-Made Products

Crafting customized solutions to meet unique client needs effectively.

Client-Centric Approach

Prioritizing client satisfaction through personalized support and engagement.

Rapid Expansion with Impact

Scaling operations strategically while maximizing positive outcomes.

Public Outreach

Engaging communities through awareness, education, and collaborative initiatives.

CORE VALUES

Strategic Objectives for a Resilient Future

Inclusivity and Equality

Promoting equal opportunities and valuing every voice for fair and diverse participation.

Innovation and Technology-Driven Solutions

We will significantly invest in digital transformation to enhance efficiency, outreach, and user experience. This includes:

Social and Environmental Responsibility

Actively promoting sustainable practices and positive social impact to protect the environment and support communities.

Empowerment and Capacity Building

Strengthening individuals and communities with skills, knowledge, and resources to thrive and lead sustainably.

GOALS

Strategic Goals

Regional Outlook

As our systems and capacity mature, Uzima aims to scale its proven model across the East African region, sharing our expertise in community-based financial inclusion & sustainable development

Sustainability and Social Impact

Our long-term vision is to balance financial sustainability with social impact, ensuring that growth not only supports our operations but also uplifts the communities we serve

National Expansion to Reach Underserved Households

Uzima’s foremost goal is to expand its operational footprint to every district of Uganda, with a deliberate focus on rural, hard-to-reach, and economically marginalized communities.

Innovation and Digital Transformation

Uzima is committed to leveraging technology and innovative solutions to enhance service delivery, improve efficiency, and ensure greater accessibility for clients across all regions

APRIL 2025

Operational Footprint

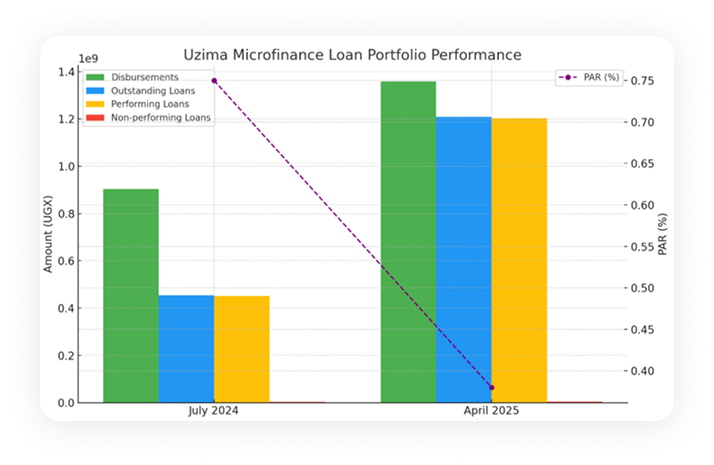

Uzima Microfinance Uganda Ltd. has established a growing operational footprint across key districts in Eastern Uganda, with active branches in Tororo, Mbale, Kumi, and Soroti. These strategic locations enable Uzima to effectively reach underserved rural and peri-urban communities, ensuring financial services are accessible to those who need them most. With a network of dedicated staff and field officers, Uzima provides doorstep financial inclusion and personalized support to nearly 5,000 clients. The institution’s operational model is built on a deep understanding of local socio-economic contexts, enabling efficient outreach, strong portfolio performance, and meaningful social impact. As demand continues to rise, Uzima plans to further expand its footprint into new districts and regions, scaling its mission of inclusive, client-centered financial empowerment across Uganda

APRIL 2025

Operational Footprint

Uzima Microfinance Uganda Ltd. has established a growing operational footprint across key districts in Eastern Uganda, with active branches in Tororo, Mbale, Kumi, and Soroti. These strategic locations enable Uzima to effectively reach underserved rural and peri-urban communities, ensuring financial services are accessible to those who need them most. With a network of dedicated staff and field officers, Uzima provides doorstep financial inclusion and personalized support to nearly 5,000 clients. The institution’s operational model is built on a deep understanding of local socio-economic contexts, enabling efficient outreach, strong portfolio performance, and meaningful social impact. As demand continues to rise, Uzima plans to further expand its footprint into new districts and regions, scaling its mission of inclusive, client-centered financial empowerment across Uganda